The economics of skincare

A couple years ago, my skin was bad, severe acne, hyperpigmentation. I spent months following estheticians online, doing facials, learning what ingredient does what, trying to decode my own skin. I spent a lot on Dermalogica and other dermatologist-backed products. My skin cleared. When my routine became maintenance, not prescriptive, I discovered K-beauty (especially SKIN1004). Great ingredients, simple formulations, and that unmistakable feeling when you touch a product and just know thought went into it. Quality and cost found equilibrium.

This is a story about how I think of skincare economics, and how it is rapidly changing.

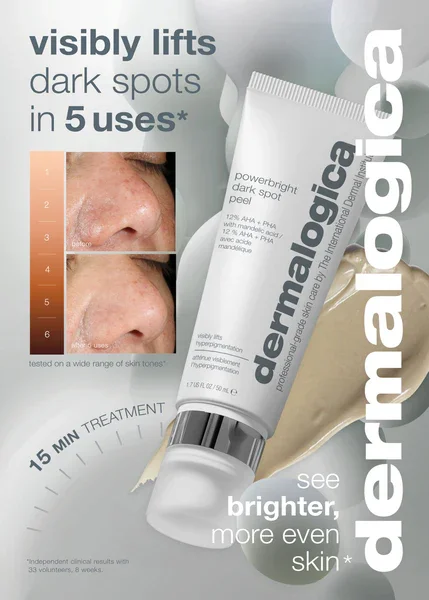

Dermalogica & the price of trust when you're going through it

When I was in undergrad, I experienced really bad breakouts. I didn't have much money, but I needed something that would work. Premium felt necessary: not because I fully understood the science, but because I believed in the clinical language, the professional endorsements, the carefully sourced ingredients.

Dermalogica became my go-to. Their entire approach felt institutional in a reassuring way: chat with skin specialist, virtual skin consultation, in-person aesthetician appointments, customized treatments, tech for skin analysis, product lines stocked in facial salons near you, a detailed ingredient library on their website, formulations for every specific concern.

It all signaled expertise. But a routine built exclusively around their products could easily cost upwards of $200 for just a few items.

What did that money actually buy? Looking back, it bought certainty. When you're dealing with skin that's actively rebelling against you, certainty is worth paying for. Dermalogica's extensive ingredient glossary lists everything from Alpha Hydroxy Acids for exfoliation to their patented TT Complex that works with the skin's natural microbiome (Dermalogica). These were a curriculum for me to learn what I needed.

The truth is, when you're twenty something and your face is going through it, 'investment skincare' means exactly what it sounds like: you're investing in the hope that someone smarter than you has already figured this out.

Prevention over correction

Once my skin stabilized, everything changed. I wasn't problem-solving anymore, I was maintaining. And that's when I discovered K-beauty, particularly SKIN1004 and their Madagascar Centella Asiatica line.

Here's what struck me first: the way the products feel. K-beauty operates on a fundamentally different design philosophy, one that treats the sensory experience as part of the efficacy. SKIN1004 sources their Centella from Madagascar, grown at 700 meters above sea level in volcanic soil rich with biodiversity. The plant contains significantly higher concentrations of madecassoside and TECA: the core actives known for soothing irritated skin (SKIN1004). But beyond the ingredients, there's an intentionality to texture that Western brands rarely match.

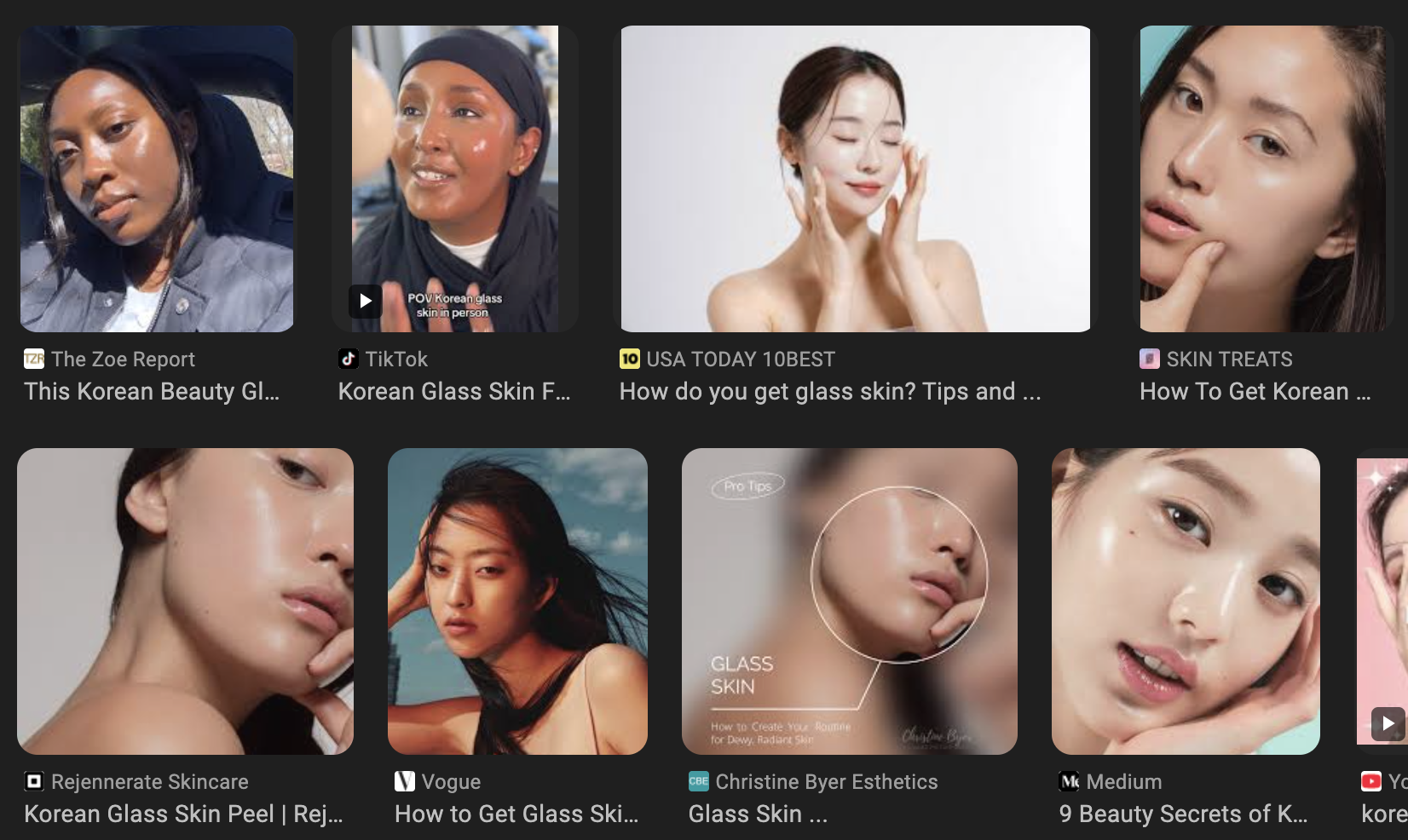

K-beauty is built on what the industry calls a 'skincare-first philosophy,' the belief that makeup should enhance natural beauty, not mask it. The ultimate goal of 'gwang' or glowing skin requires consistent, layered care that prioritizes prevention and protection over short-term fixes (Mintel/Black Swan Data). Western skincare, by contrast, tends to be reactive, targeting areas of damage after they appear.

The price points initially surprised me. How could something this good cost this little? But the math makes sense: K-beauty brands have optimized their supply chains, embraced contract manufacturing at scale, and built business models around high volume rather than high margins.

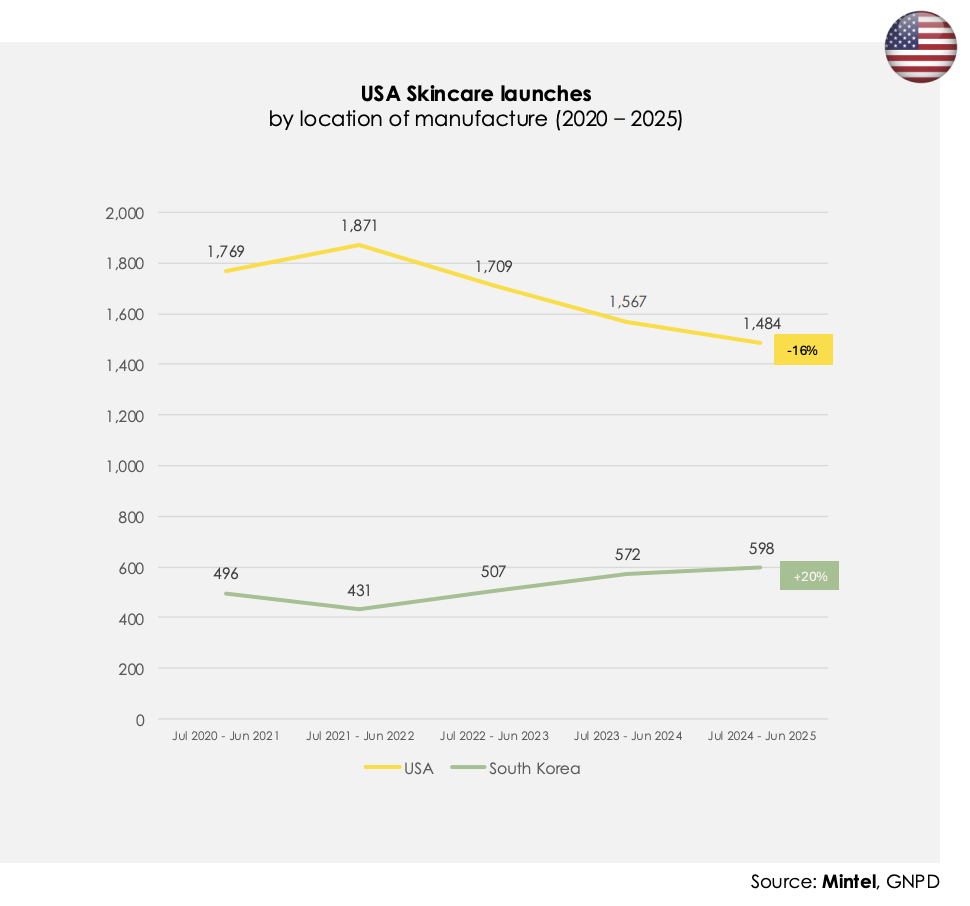

Since 2020, there's been a 20% increase in launches of Korean-made skincare products in the US. In that same period, there's been a 16% drop in skincare products manufactured domestically. (Mintel/Black Swan Data)

This represents K-Beauty 3.0: a shift away from novelty items like sheet masks to advanced, tech-driven skincare solutions. The innovation hasn't slowed; it's just become more accessible

Understanding skincare pricing tiers

Skincare pricing varies dramatically based on brand positioning, ingredient sourcing, concentration, and formulation complexity. The beauty market breaks down into five price segments, each with its own logic (BoF-McKinsey: Beauty 2025).

Here's how the market breaks down for a standard 50ml moisturizer:

| Tier | Price Range | Example Brands | Characteristics |

|---|---|---|---|

| Luxury | $200–$3,000+ | Sisley Paris, La Prairie, The History of Whoo | Rare ingredients, bespoke formulations, high-touch service |

| Prestige | $80–$200 | Clarins, Tatcha, SK-II | Clinical-grade actives, elegant textures, proven efficacy |

| Entry Prestige | $40–$80 | La Roche-Posay, Dermalogica | Dermatologist-backed, high concentrations |

| Masstige | $20–$40 | COSRX, The Ordinary, CeraVe | Effective actives, no-frills packaging |

| Mass | <$20 | Neutrogena, Nivea, E.l.f. | Accessible, basic formulations |

Here's what's interesting: 61% of global consumers list a mass brand as their most-purchased skincare brand, but only 47% list mass as their favorite. The gap reveals the tension: people buy affordable, but they may admire prestige. K-beauty has exploited this perfectly, delivering prestige-level efficacy at masstige prices.

K-BEAUTY (Korean Beauty): ingredients, pricing, trends

Philosophy: "Gwang" (光) – the pursuit of glass-like, luminous skin through layered, preventative care. K-Beauty prioritizes skin barrier health, hydration, and long-term results over quick fixes. Since 2020, there's been a 20% increase in Korean-made skincare product launches in the US. (Mintel/Black Swan Data)

| Ingredient | How It Works | Typical Price | Trend Status |

|---|---|---|---|

| Centella Asiatica (Cica) | Locks in hydration, enhances moisture content, reduces fine lines. Madagascar-grown centella contains higher concentrations of madecassoside and TECA for powerful soothing effects. (SKIN1004, Dermalogica) | $15–$45 | Growing |

| Snail Mucin | Contains glycoproteins, hyaluronic acid, and glycolic acid naturally. Promotes wound healing and hydration. | $12–$35 | Established |

| Fermented Ingredients | Lactobacillus Ferment Lysate helps firm and hydrate skin while protecting barrier integrity. Fermentation increases bioavailability. (Mintel) | $20–$60 | Growing |

| Panax Ginseng | Energizes skin, provides antioxidant protection, traditionally used for vitality. (Mintel/Black Swan) | $18–$50 | Growing |

| PDRN (Salmon DNA) | Regenerative ingredient for skin repair. Now being combined with exosomes and lotus flower in advanced formulations. (Mintel) | $40–$150 | Emerging |

| Spicules (Reedle Shots) | Fine needle-like structures from marine sponges that create microchannels for enhanced ingredient delivery. (Mintel) | $25–$60 | Trending |

| Niacinamide | Reduces visible aging, fades post-inflammatory hyperpigmentation, regulates oil. Often at 10% concentration. (Dermalogica) | $8–$30 | Mature |

| Propolis | Bee-derived ingredient with antibacterial and healing properties. Popular for acne-prone skin. | $15–$40 | Established |

J-BEAUTY (Japanese Beauty): ingredients, pricing, trends

Philosophy: "Mochi-hada" (餅肌) – achieving skin as soft and bouncy as mochi rice cake. J-Beauty emphasizes simplicity, purity, and time-honored rituals with meticulous attention to texture and sensory experience. (Tatcha)

| Ingredient | How It Works | Typical Price | Trend Status |

|---|---|---|---|

| Japanese Rice Bran | Decongests pores, brightens skin, and allows better absorption of subsequent products. Rich in vitamins B and E. | $25–$65 | Traditional |

| Silk Proteins | Easily absorbed, helps skin look healthier, smoother, and plumper. Used in geisha beauty rituals. | $30–$80 | Niche |

| Camellia Oil (Tsubaki) | Feather-light, fast-absorbing oil treasured in Japanese skincare for deep nourishment without heaviness. | $20–$55 | Traditional |

| Japanese Matcha | Powerful antioxidant rich in catechins. Beneficial both consumed and applied topically. | $25–$60 | Growing |

| Pearl | Luminescent and potent antioxidant, rich in amino acids, minerals, polysaccharides, and proteins. | $35–$90 | Luxury |

| Yomogi (Japanese Mugwort) | Known as 'Queen of Herbs,' this sacred botanical helps visibly calm and hydrate skin. | $22–$50 | Trending |

| Japanese Indigo | Deeply soothing, restorative, and calming. Supports the skin barrier. | $28–$60 | Niche |

| Coix Seed Extract | Ancient grain used as holistic remedy for centuries, prized for anti-inflammatory properties. | $20–$45 | Traditional |

| Green Tea (Camellia Sinensis) | Soothing antioxidant with anti-inflammatory properties. Green Tea Phenols (GTP) help protect skin against pollution and oxidative stress; effective for rosacea and acne. | $15–$50 | Mature |

| Licorice Root | Naturally antibacterial and anti-inflammatory. Visibly brightens and evens skin tone while fading dark spots. Gentle alternative to harsher brightening agents. | $18–$55 | Growing |

| Hyaluronic Acid | Powerful humectant that attracts and retains moisture, plumping skin and reducing fine lines. Japanese formulations often use multiple molecular weights for multi-level hydration. | $12–$60 | Mature |

| Collagen | Structural protein that improves skin firmness and elasticity. Topical forms hydrate and plump; marine collagen popular in J-Beauty for better absorption. Often paired with vitamin C to boost synthesis. | $20–$75 | Growing |

| Yuzu Extract | Japanese citrus fruit exceptionally rich in Vitamin C (3x more than lemons). Brightens skin, provides antioxidant protection, and delivers an uplifting aromatherapy experience. | $25–$70 | Trending |

| Wakame Seaweed | Mineral-rich marine algae that hydrates, detoxifies, and protects skin. Contains fucoidan which helps inhibit enzymes that break down collagen and elastin. Staple in Japanese coastal beauty rituals. | $22–$65 | Growing |

FRENCH BEAUTY (La Beauté Française): ingredients, pricing, trends

Philosophy: French beauty blends sensorial luxury with clinical efficacy, often anchored in thermal water science and terroir-driven botanicals. Brands like Caudalie pioneered "Vinothérapie" using grape-derived actives. (Caudalie)

| Ingredient | How It Works | Typical Price | Trend Status |

|---|---|---|---|

| Grape-Seed Polyphenols | Powerful antioxidants from French vineyards (Bordeaux, Champagne, Burgundy). Reduce free radical activity and condition skin. (Caudalie) | $35–$95 | Signature |

| Viniferine | Extracted from grapevine sap, 62x more effective than vitamin C for brightening. Caudalie's patented ingredient. (Caudalie) | $45–$120 | Exclusive |

| Vine Resveratrol | Anti-aging powerhouse with antioxidant properties. Protects against free radicals and supports skin firmness. (Caudalie) | $40–$100 | Established |

| Thermal Spring Water | Mineral-rich water from volcanic springs. Soothes, hydrates, and strengthens skin barrier. | $10–$35 | Foundation |

| French Green Clay | Absorbs excess oil and debris, leaving skin purified and clear. Traditional detoxifying ingredient. | $12–$30 | Traditional |

| Rose Essential Oil | Precious oil used in Vinothérapie spas since 1999. Soothes and provides luxurious sensorial experience. | $50–$150 | Luxury |

| Hyaluronic Acid | Clinically proven hydrator used at various molecular weights for multi-level moisture penetration. | $15–$60 | Universal |

| Organic Shea Butter | Traditional West African ingredient, now staple in French formulations for intense nourishment. | $8–$25 | Traditional |

Pricing and efficacy of clinical actives

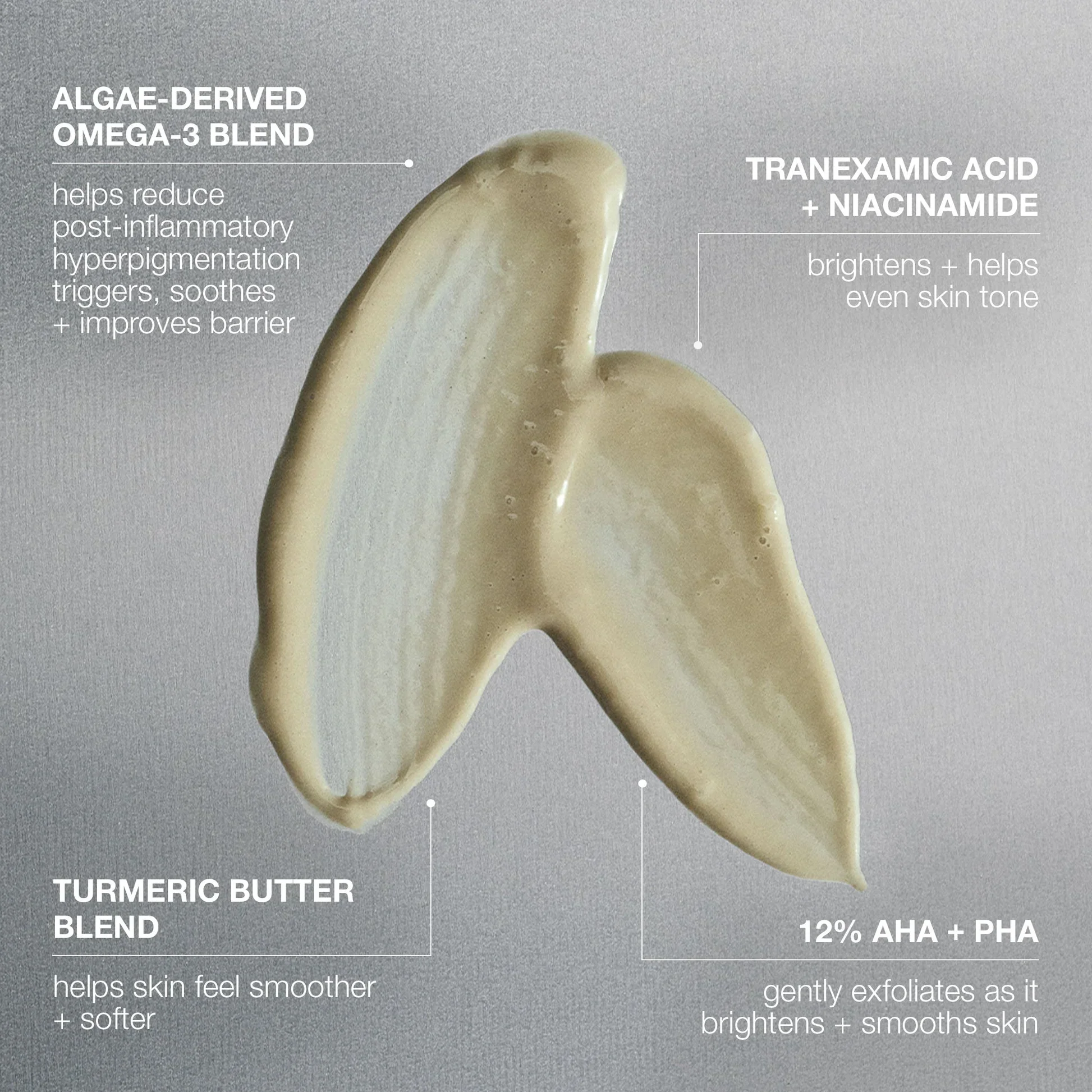

When evaluating the economics of skincare, clinical actives offer perhaps the best value-to-efficacy ratio on the market. Unlike regional beauty ingredients whose pricing often reflects sourcing rarity or brand heritage, clinical actives like retinol, niacinamide, and hyaluronic acid are priced primarily on concentration and formulation stability, and decades of peer-reviewed research back their claims.

A $10 bottle of 10% niacinamide can outperform a $150 "luxury" serum with undisclosed percentages of the same ingredient. The key is understanding that efficacy lives in the percentages: a 0.5% retinol will deliver measurable results regardless of whether it's housed in minimalist packaging or a gold-plated jar.

Mass and masstige brands have capitalized on this reality. For budget-conscious consumers, clinical actives represent the democratization of effective skincare: the science is public, the concentrations are standardized, and the results are reproducible across price points.

| Ingredient | Effective % | Primary Use | Price Range | Rx Required? |

|---|---|---|---|---|

| Retinol (OTC) | 0.1–1% | Anti-aging, cell turnover, texture | $15–$80 | No |

| Tretinoin (Rx) | 0.025–0.1% | Prescription retinoid, acne, aging | $30–$150 | Yes |

| Vitamin C (L-AA) | 10–20% | Brightening, antioxidant, collagen | $20–$165 | No |

| Niacinamide | 2–10% | Barrier repair, oil control, pores | $8–$45 | No |

| Hyaluronic Acid | 0.1–2% | Hydration, plumping | $10–$60 | No |

| Salicylic Acid | 0.5–2% | Acne, pore clearing (BHA) | $8–$40 | No |

| Glycolic Acid | 1–30% | Exfoliation, texture (AHA) | $12–$90 | High % Rx |

| Azelaic Acid | 10–20% | Acne, rosacea, brightening | $15–$50 | 15%+ Rx |

| Hydroquinone | 2–4% | Hyperpigmentation (limited use) | $20–$80 | 2%+ varies |

| Tranexamic Acid | 2–5% | Melasma, stubborn pigmentation | $25–$70 | No |

| Benzoyl Peroxide | 2.5–10% | Acne (antibacterial) | $5–$25 | No |

| Ceramides | Varies | Barrier repair, moisture lock | $12–$55 | No |

What drives ingredient pricing

The price of a skincare product is influenced by multiple factors beyond just the active ingredients:

1. Ingredient Sourcing & Rarity

Madagascar Centella Asiatica: Grown at 700 meters elevation with specific climate conditions, resulting in higher TECA concentrations than generic sources. (SKIN1004)

French Vineyard Extracts: Sourced from Bordeaux, Champagne, and Burgundy vineyards with terroir-specific polyphenol profiles. (Caudalie)

Japanese Camellia Oil: Traditional cold-pressing methods yield lower quantities but preserve more nutrients. (Tatcha)

2. Concentration & Formulation

Higher concentrations = Higher cost: A 20% Vitamin C serum costs significantly more to formulate than 5%

Delivery systems: Encapsulated retinol, liposomal vitamin C, or nano-hyaluronic acid add formulation complexity

Stability: Antioxidants like Vitamin C require special packaging and preservation

3. Brand Positioning

63% of consumers don't think premium beauty performs better than mass, yet mass and masstige brands now hold 68% of skincare market share globally. K-Beauty's success proves high-efficacy skincare can be accessible. (BoF-McKinsey: Beauty 2025)

4. Emerging vs. Established Ingredients

Emerging (Premium): PDRN, Exosomes, Bakuchiol, Peptide Complexes

Growing (Mid-range): Centella, Lactobacillus Ferments, Pearl Powder

Mature (Accessible): Hyaluronic Acid, Niacinamide, Retinol, Vitamin C

The market is responding & retailers are reading the room

US retailers are scrambling. Ulta has partnered with K-Beauty World, adding 13 Korean brands to its shelves and online store. Walgreens launched its own Korean skincare dupes in 2024, followed by the K-inspired I Dew Care brand. The war for K-beauty is reshaping American retail.

Olive Young (South Korea's answer to Ulta Beauty, with over 1,370 stores domestically) is opening its first US location in Pasadena, California in May 2026, with Century City following the same month (Business of Fashion). Unlike Sephora and Ulta, which focus on a handful of big-name brands, Olive Young is built around discovery, curating a mix of established and emerging Korean brands.

What happens when the value proposition actually makes sense?

Mass brands are gaining ground through four major shifts (BoF-McKinsey):

elevated product quality (challenger brands now adopt similar codes to prestige: popular ingredients, attractive packaging, scientific claims)

increased availability across channels

broader visibility through TikTok and Instagram virality

increased consumer attention as newer beauty consumers favor accessible pricing

The global share of mass and masstige segments within skincare has grown by 5 percentage points over the past five years. In color cosmetics, it's grown by 4 points.

Quality and cost found equilibrium

The $441 billion global beauty industry is cooling after years of 7% annual growth. The industry is expected to settle at 5% annually through 2030, still healthy, but a new normal (BoF-McKinsey).

For consumers, this is mostly good news. Affordable products are better than ever, information is everywhere, and the old gatekeepers (department store counters, dermatologist recommendations) now compete with a thousand voices saying the same thing: you don't have to overpay for good skin.

My shift from Dermalogica to K-beauty was never about abandoning quality. There are still Dermalogica products I keep around; some things just work. But it took years of personal research, a lot of trial and error, and honestly, good timing; K-beauty's rise in the US met me right when I was ready to question what I was paying for. I still love a good facial. I'll always invest in treatments that make sense. But finding products that deliver real results without the markup? That feeling is different. It's validating in a way that's hard to explain.

Quality and cost found equilibrium. The market is catching up.

Thank you for thinking with me. This piece is part of Ode by Muno, where I explore the invisible systems shaping how we sense, think, and create.

The quote at the intro is from the book, Systems Intelligence.