Why beauty brands are redesigning experience around touch

I used to go to Sephora's free in-store classes back in 2016. They stopped offering them, and I didn't realize how much I'd miss having that be a third place for me. Now everything costs something; your time on YouTube, your money on masterclasses, your attention sorting through conflicting TikTok advice. Beauty became this solitary research project. But lately, I've noticed a shift. SEPHORiA's coming back in 2026. Brands are hosting more events. And then there are the brand trips to Positano villas, Dubai hotels, Paris launches. The luxury isn't just the product anymore; it's the invitation. Being chosen. Creators document exclusive experiences, and suddenly the aspiration isn't owning the $65 foundation, it's being in the room where it launched & I want to be in the same room, learning together, celebrating together. To access to the experience of discovery itself, or at least, proximity to it.

The gap between what we say and what we choose

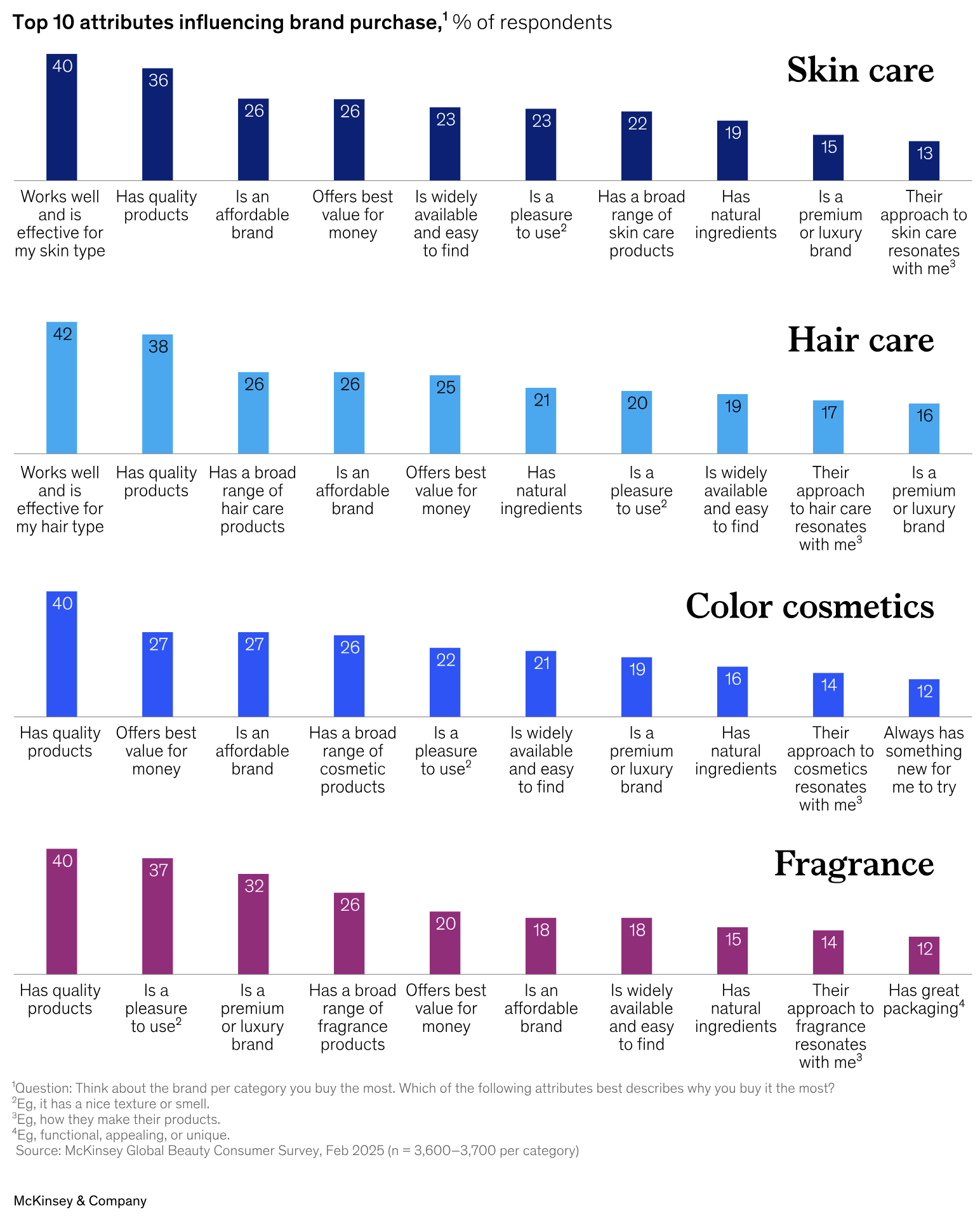

There's something interesting happening in beauty consumer data. When asked what matters most, 40-42% of people say efficacy for their specific type. Quality products come in second at 36-40%. Affordability ranks third.

"Pleasure to use" sits at 20-23% for skincare and hair care: categories you touch twice a day minimum, sometimes more. Products you squeeze, pump, smooth, work through your hands before they ever reach your face or hair. The physical interaction is half the routine, but it doesn't crack the top three priorities.

On paper, we're rational. We want things that work, that are well-made, that don't cost too much. Touch is secondary.

But then you walk into a store and you pick up the bottle anyway. You test the texture on the back of your hand. You feel the weight of the packaging. You notice whether the pump is smooth or stiff, whether the cream absorbs or sits on your skin. Your hands are gathering information your brain hasn't consciously requested.

And that's what brands are betting on.

Look at what's actually growing: experiential retail with testing zones where you can touch everything. K-beauty's entire design philosophy built around tactile satisfaction: the snap of a cushion compact, the cooling sensation of a gel, the way a serum feels between your fingers before it reaches your face.

These investments prioritize sensory experience and resonance; areas that sit at 13-20% in surveys but drive actual purchase behavior in ways efficacy claims can't.

I think we answer surveys the way we think we're supposed to: logically, practically. "Does it work for my skin type?" is the defensible answer. It's measurable. It's what you'd tell a friend who asked for a recommendation.

But in practice? You're also deciding based on how the bottle feels in your hand. Maybe we don't think of pleasure as a legitimate decision factor. Or maybe we just don't have language for it yet. Your hands know things your brain hasn't processed. The data will tell you what works. But touch tells you whether you'll actually use it.

Sephora's experiential dominance

Most beauty retail before Sephora was locked behind glass or tied to individual brand counters. You asked a sales associate to show you something. You got a consultation from someone who only represented one brand. The experience was transactional, controlled.

Sephora opened everything up. Try whatever you want. Test as many shades as you need. Compare brands side by side. Take samples home. Their model was built on touch as confirmation: the idea that physical interaction verifies what your eyes and marketing can't fully communicate.

Then they kept building. Free in-store beauty classes became regular programming. Color IQ technology reduced shade-matching guesswork. Sephora Squad turned customers into community ambassadors. SEPHORiA launched as a cultural beauty event, coming back to LA in March 2026. The entire infrastructure (from store layout to digital tools to community programs) was designed around one principle: let people experience products before they commit.

But as e-commerce grew, Sephora faced a new challenge. How do you compete with the convenience of online shopping while maintaining what makes physical retail valuable? Their answer wasn't to retreat from stores. It was to double down on what stores do better than screens.

In 2022, Sephora Asia partnered with IDEO to prototype the "Store of the Future," a full-floor concept in IDEO's Shanghai office testing blended digital-physical experiences. The insight driving the design: people have different emotional needs depending on what they're buying. Makeup shopping feels exploratory, playful, about self-expression. Skincare shopping, especially when addressing a specific concern, feels vulnerable. One requires freedom to experiment. The other requires personalized guidance.

So they built for both. The "Play Table" let customers freely explore products with digital platforms providing reviews and details; Sephora leaning into its strength as a neutral multi-brand space, not a paid influencer. The "Sephora Beauty School" offered hands-on classes and community activities where you could test techniques you'd seen online. The "Care Table" provided semi-private consultations with digital skin analysis tools, creating a setting closer to medical care than makeup counter.

The first "Store of the Future" launched in Singapore in 2022, followed by Shanghai in 2023. The Shanghai store saw 107% traffic increase within four months. Sephora now tracks "engagement indicators" of how customers interact with each digital touchpoint to keep iterating based on what people actually use, not what they say they want.

Other retailers are trying to catch up, but from different starting points. Department stores like Macy's, Nordstrom, and Bloomingdale's still operate the traditional beauty counter model: you go to the Estée Lauder counter for Estée Lauder, the Clinique counter for Clinique, the MAC counter for MAC. The expertise is deep but siloed. You're not getting cross-brand comparisons or unbiased recommendations; the person helping you works for that specific brand. Nordstrom has experimented with open-sell beauty areas and spa services, but the core structure remains brand-by-brand counters.

Ulta Beauty is expanding K-beauty brands and hosting more in-store events, leaning into accessibility rather than aspirational experience. They acquired Space NK in July 2025 to accelerate UK and Ireland expansion, but shopping at Sephora and Ulta remains fundamentally different. One prioritizes range and value. The other prioritizes discovery and experience.

Sephora didn't just adapt to experiential retail. They defined it, then kept redefining it. The model is clear: brands aren't just responding to survey data. They're responding to what we actually do. And what we do, consistently, is choose the place that lets us touch, test, learn, and feel confident before we buy.

The consistent experiential innovations by L'Oréal

L'Oréal has quietly become one of the most sophisticated experience engineers in beauty. Through ModiFace (the AR company they acquired), they're not just adding tech for novelty. They're redesigning how culture, identity, and product discovery work together.

Take the YSL Beauty Hyper Look Studio. Makeup discovery doesn't start at the counter anymore, it starts at the scroll. You see a trend on TikTok, the AI translates it into products you can actually try on your face in real time. Color, sound, virtual try-on. It's building trust through interaction before you ever touch the product.

Then there's the YSL Scent Station they've rolled out in select stores. You don't just smell fragrances lined up on a counter. You answer questions about mood, memory, preference, and the system guides you through scent families with digital storytelling. It's curation meets education meets sensory confirmation.

And Perso, their at-home personalization device. It analyzes your skin and creates custom foundation, skincare, or lipstick on demand. The product itself becomes responsive to your environment and needs rather than a fixed formula you adapt to.

What L'Oréal is really scaling isn't just AR or AI. It's a system where beauty keeps pace with culture without losing craft. They're not replacing the tactile experience. They're amplifying it with data, personalization, and context. You still touch, smell, see. But now the discovery process is faster, smarter, and more aligned with how people actually move through the world.

Experience is the appeal for the creator economy

If Sephora made experience accessible to anyone who walks through the door, the rest of the industry discovered something else: exclusive experiences create a different kind of value entirely.

Brand trips used to be low-key: a dinner, maybe a weekend event. Post-pandemic, they escalated. Week-long stays in Positano. Private villas in Tulum. Launch parties in Dubai.

Premium brands rank lowest in consumer survey I showed earlier (12-16%), yet beauty brands are spending more on high-touch experiences than ever before. Brand trips aren't about selling you the serum. They're about creating a memory so tied to the product that you can't separate the two.

If you talk about a product well enough, if you can describe the texture, the way it feels, the experience of using it, brands start sending you things. First it's PR packages at your door. Then it's the invitation. The trip. The access.

Some creators genuinely don't buy beauty products anymore. They receive so much PR, they host giveaways with the overflow. The product becomes the gateway, not the end goal. What you're really gaining access to is the experience around it: the launch event, the brand relationships, the behind-the-scenes story.

Consumers watch these trips documented in real-time on Instagram and TikTok. The exclusivity is publicized. You see the villa, the sunset dinner, the founder explaining the inspiration. You're invited to watch, but not to attend. The aspiration isn't just owning the product anymore, it's being chosen.

Why we're paying for what is also free (YouTube, etc)

Beauty influencers have been around since before 2016. Jackie Aina, Jaclyn Hill, Teaira Walker: they built audiences teaching people how to do makeup at home, for free. YouTube was the democratization of beauty education. Anyone could learn anything. The barrier to entry collapsed.

But somewhere along the way, free became overwhelming.

You'd watch five tutorials on the same technique and get five different methods. You'd buy products based on reviews, only to realize your skin doesn't work like theirs. You'd spend hours researching ingredients, comparing formulations, reading conflicting advice in comment sections. The information was accessible, but making sense of it wasn't.

Trial and error is expensive when you're learning alone, not just in money, but in time and decision fatigue.

Now we’re having more paid, curated experiences led by beauty influencers.

Masterclasses where someone teaches you on your own face, in real time, with real feedback. In-person events where you can test products under proper lighting with people who understand your concerns. Demo zones in stores where experts guide you through options instead of leaving you to decode ingredient lists alone.

Brands have to think about what YouTube can’t provide: guidance that's personalized, community that's present, and the chance to touch and confirm before committing.

What digital can't teach you

The shift reveals something fundamental about learning in tactile categories: screens can show you technique, but they can't teach you texture.

You can watch someone apply foundation flawlessly, but you can't feel how it sits on their skin. You can see the finish in HD, but you don't know if it feels heavy or breathable. You can't smell the fragrance. You can't test how it oxidizes on your specific skin chemistry over four hours. You can't feel whether the pump dispenses too much product or whether the bottle feels cheap in your hand.

Beauty is a multi-sensory category collapsed into a visual medium. And we've been trying to make purchasing decisions based on incomplete data.

That's why even the most detailed reviews leave gaps. A creator can tell you a moisturizer is "lightweight" and "fast-absorbing," but lightweight to someone with dry skin feels different than lightweight to someone with oily skin. Fast-absorbing compared to what? And does it leave a residue you can feel but can't see on camera?

Digital learning in beauty optimized for scalability and convenience. It gave us access to techniques we'd never have learned otherwise. But it couldn't solve for the fact that your hands need to verify what your eyes can't fully process.

The limit isn't the quality of digital content. It's the medium itself. Beauty is a category you learn through your body, not just your screen.

What would help is better sensory language

If digital learning in tactile categories has limits, the question becomes: how do you design for both the scalability of digital and the necessity of physical confirmation?

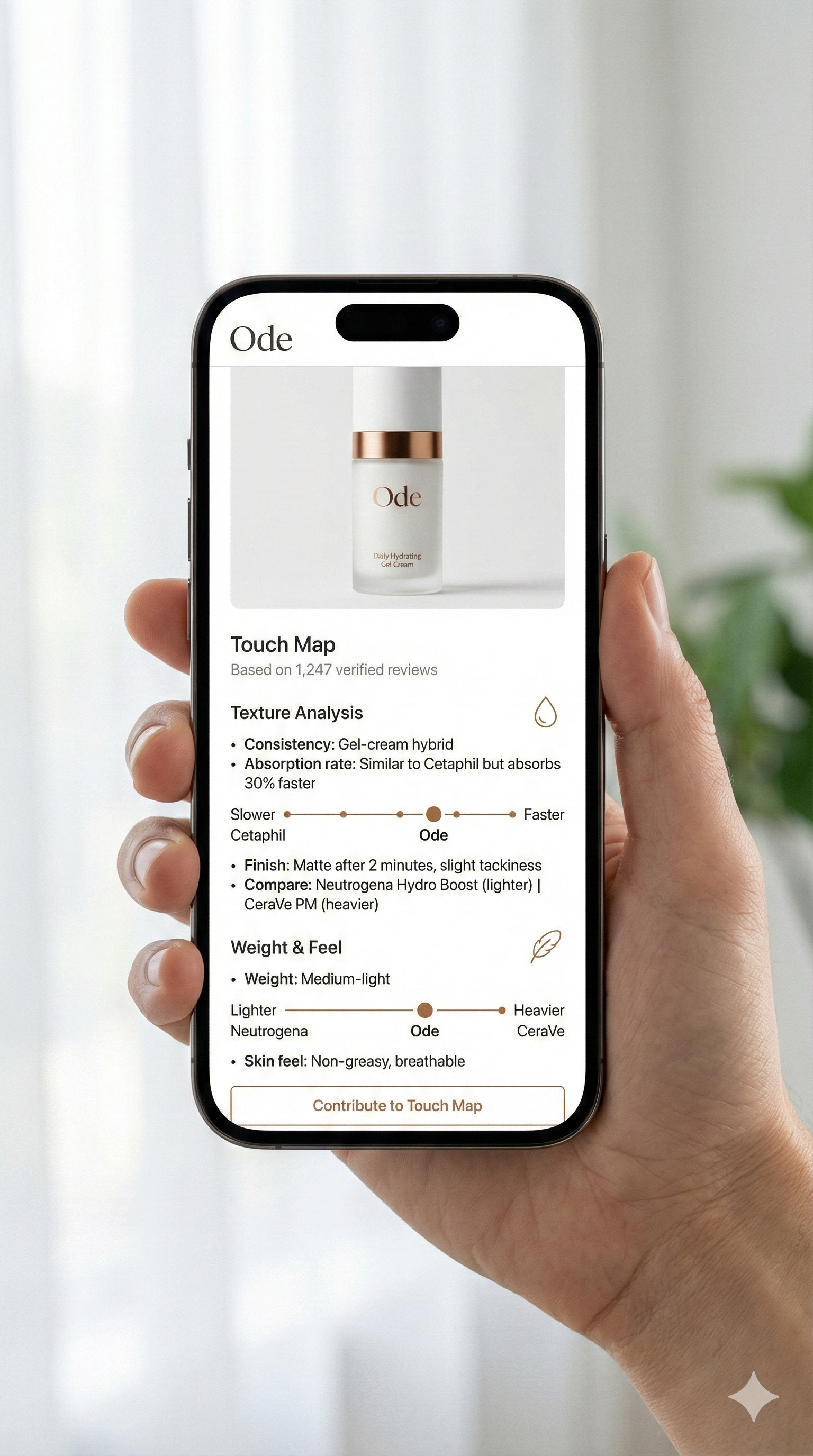

Conceptual visualization for what is to come. Co-created with Gemini

Some possibilities:

Better sensory language Most product descriptions are vague. "Smooth texture." "Fresh scent." "Lightweight feel." These mean nothing because they're relative. What if descriptions were standardized and comparative?

"Texture: similar to Cetaphil but absorbs 30% faster."

"Scent: citrus-forward, fades within 20 minutes, no lingering residue."

"Weight: lighter than CeraVe, heavier than Neutrogena Hydro Boost."

Give people reference points. Let them map new products onto things they've already touched.

Hybrid models Sephora's approach works because it combines digital research with physical confirmation. You browse online, but you test in-store before buying. Digital for discovery and education. Physical for confirmation and personalization. The brands that have the best shopping experiences are the ones that make the transition between the two seamless.

Community-driven texture libraries Imagine a database where people describe products using consistent vocabulary, tagged by skin type and concern. Not "This is amazing!" but "Texture: gel-cream hybrid, absorbs in 45 seconds, slight tackiness for 2 minutes, then matte finish. Comparable to: X, Y, Z." Crowdsourced sensory data that actually helps people predict how something will feel before they buy it.

Sampling as standard K-beauty figured this out. Samples are part of the purchase model. You buy the full size only after you've tested it on your own skin for a week. Western brands are starting to catch up, but the culture is still "buy it and return it if it doesn't work" rather than "try it first, then commit." Sampling reduces waste, decision fatigue, and the cost of trial and error. It also acknowledges that digital content can inform but not replace tactile experience.

AR and haptic feedback (eventually) Augmented reality is trying to solve for visual confirmation, virtual try-on for makeup shades, hair color, even skin texture simulation. It's improving, but it's still very limited. Haptic feedback technology could eventually communicate texture digitally. Imagine holding your phone and feeling the difference between a gel moisturizer and a cream through vibration patterns. We're not there yet, but the technology exists in other industries. Gaming controllers use haptics to simulate terrain. Why not beauty?

The limit of digital learning in tactile categories isn't that it's bad. It's that it's incomplete. Curious to see how this space evolves.

Thank you for thinking with me. This piece is part of Ode by Muno, where I explore the invisible systems shaping how we sense, think, and create.

The quote at the intro is from the book, Systems Intelligence.