The digital divide 2.0

“In order to act more intelligently in the holistic systemic environment, I need to mirror mental models and engage in meta-level thinking regarding my own thinking, in order to change my behaviours and actions to be more in line with my true aspirations, interests and the parameters at hand, as they appear in the environment in which I operate.”

I was wondering, if the “Imagine if…” spaces from the last post (the watch-together theaters, the creator cafés, the tasting lounges, the living-room gyms) actually came to life, where would they show up first? Probably the places that already have the infrastructure, the money, the tech, the density. Meaning the cities that are already ahead get further ahead, and the places already struggling fall even further behind.

This is the Digital Divide 2.0 & it’s quietly reshaping where we live, how we work, and what opportunities we have access to.

The new geography of intelligence

The original digital divide was binary: connected or not. The new divide operates on a spectrum.

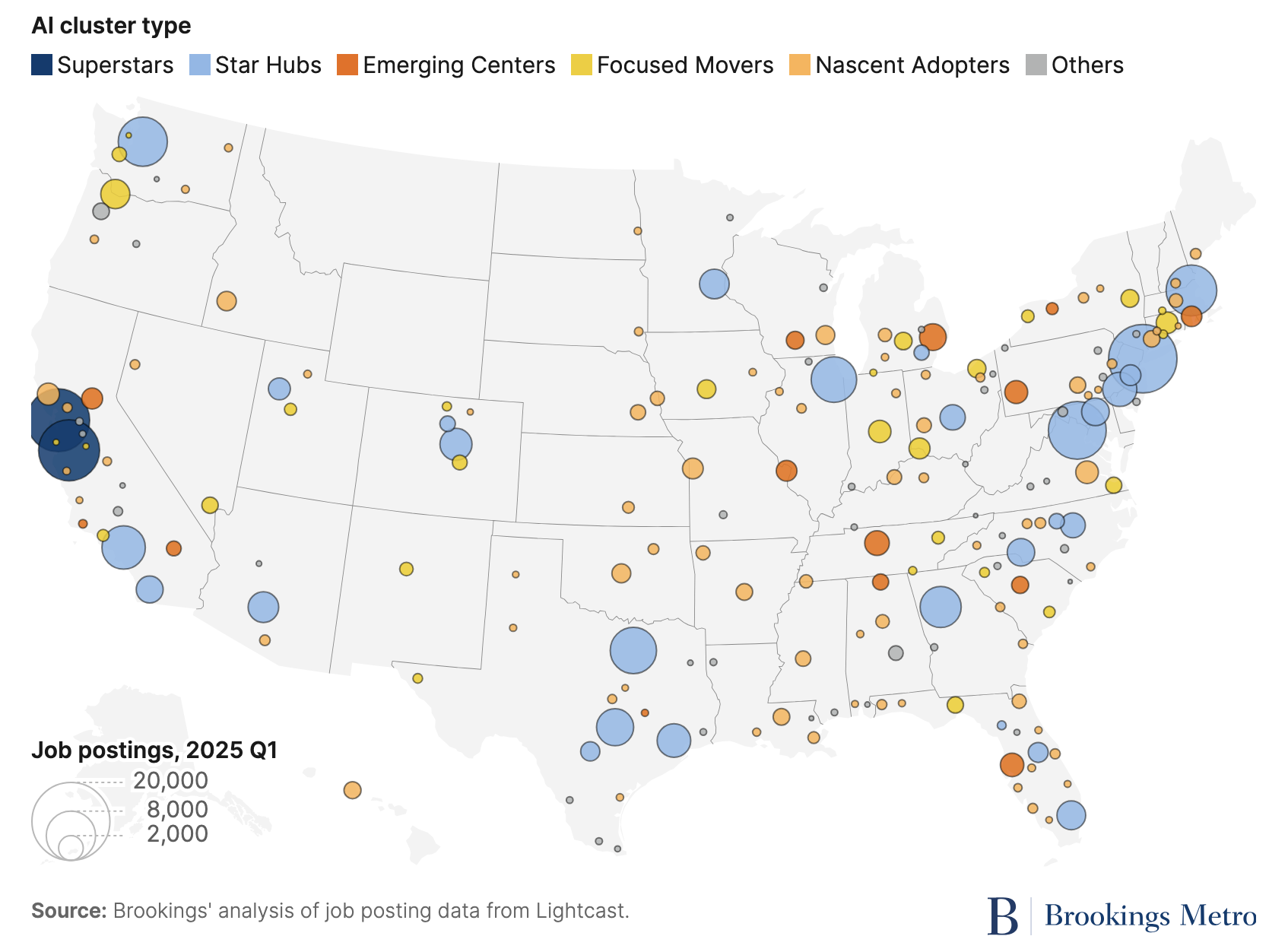

Consider what's happened in the past eighteen months. Generative AI has moved from novelty to necessity. ChatGPT reached 100 million users faster than any application in history. Companies are projected to spend $500 billion+ annually on AI infrastructure (ubs.com). And here's the pattern that's emerging: most of the AI engineers in the United States are concentrated in just two metropolitan areas: San Francisco and San Jose (brookings.edu). The Bay Area alone accounts for 13% of all national job postings featuring AI skills (bizjournals.com). Meanwhile, over half of U.S. metro areas remain in the bottom two tiers of AI readiness.

“Altogether, then, 67% of the nation’s total AI employment —about two-thirds of it as indicated by absolute numbers of AI-related job postings in 2025—is taking place in just the two Superstars and 28 Star Hubs. “ (brookings.edu)

Three layers of the new divide

The pattern underneath all of this: digital infrastructure is becoming as fundamental as roads and water mains. The places investing in it (and managing its downsides) are positioning for the next economy. The places ignoring it are betting that the future won't arrive. That bet is getting riskier every year.

Layer One: Access. Who can get online at all. In 2024, roughly 2.6 billion people worldwide remain unconnected to the internet (weforum.org). In the United States, one in three people still don't have internet speeds fast enough to run a video call smoothly, let alone engage with AI-powered applications. Across the African continent, just 38% of people used the internet in 2024, far below the global average of 68% (developmentaid.org).

Layer Two: Skills. Having access isn't the same as having capability. The OECD estimates that most AI-related training programs are designed for people who already possess advanced digital skills creating a scenario where those who most need AI literacy are least likely to receive it. One-third of American workers lack sufficient digital literacy, yet over 92% of jobs now require digital competencies (fcc.gov) & there's a new literacy emerging: the ability to design prompts, differentiate AI-generated content from human work, and understand the biases in algorithmic systems. Those who can't develop these skills are falling into a new kind of functional illiteracy.

Layer Three: Outcomes. This is where the divide becomes existential. Urban workers are significantly more likely to be exposed to generative AI; 32% compared to just 21% of rural workers (oecd.org). Experimental studies show that access to AI tools can dramatically boost productivity, creativity, and performance, with several finding the largest benefits for the least-skilled workers. The unfortunate irony is that those who could benefit most from AI-augmented capabilities are those least likely to have access.

Where the money is going

The AI infrastructure buildout is the largest industrial investment wave in a generation. This is fundamental restructuring.

The scale: Amazon alone announced $15 billion for data centers in Northern Indiana (amazon.com), $10 billion in Mississippi (amazon.com), and over $51.9 billion already invested in Virginia (amazon.com). Microsoft is spending $80 billion in fiscal 2025 on AI-enabled facilities (microsoft.com). OpenAI's Stargate project is deploying nearly 7 gigawatts of capacity across Texas, New Mexico, and Ohio, over $400 billion in investment (openai.com). Globally, data center spending hit $290 billion in 2024 and is projected to exceed $1 trillion annually by 2030.

McKinsey estimates that companies will need to invest $6.7 trillion into data centers by 2030 just to meet AI demand (mckinsey.com). That's roughly equivalent to the entire GDP of Japan, being poured into buildings that most people will never see or think about.

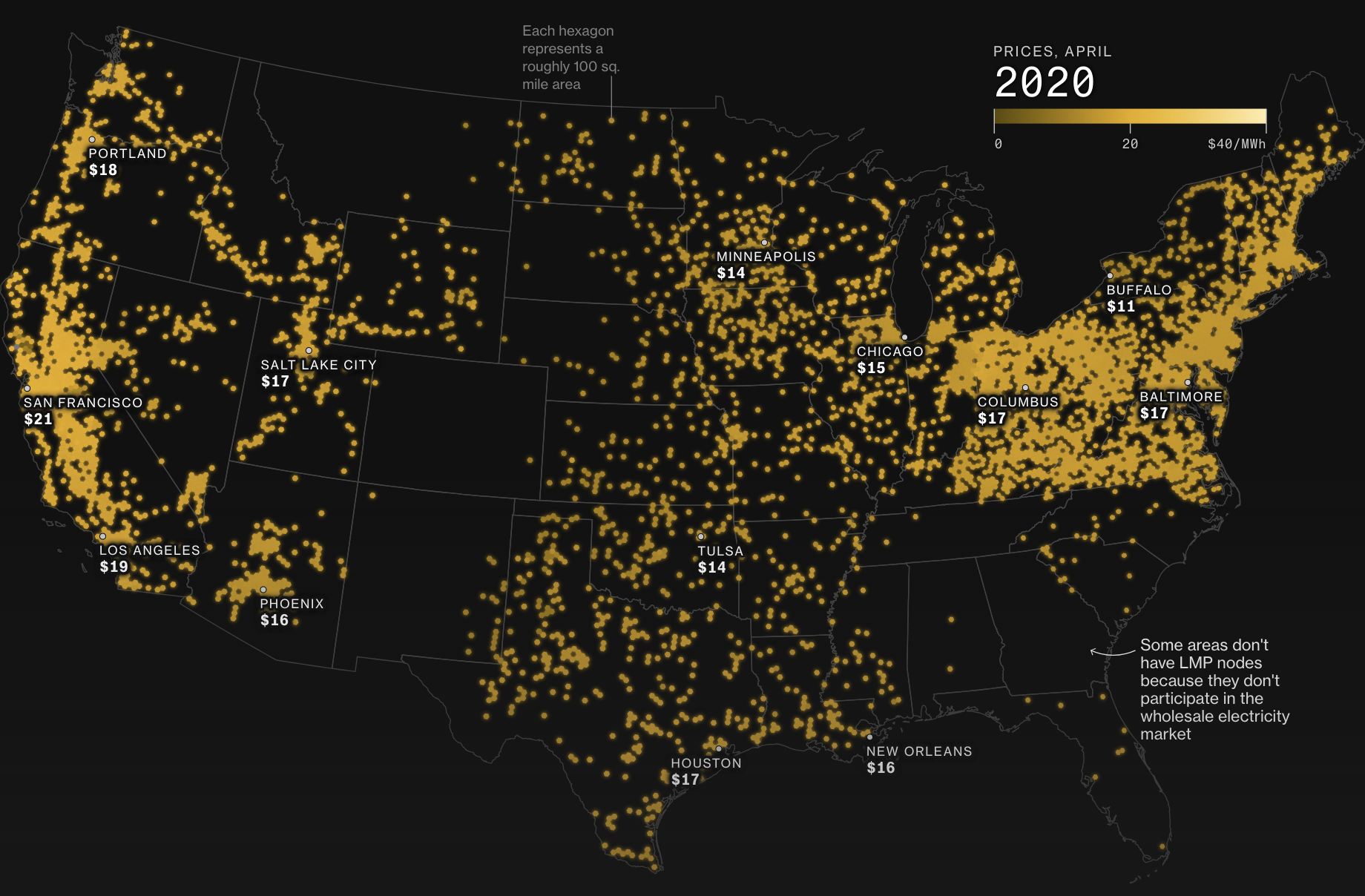

These investments are concentrated in specific regions: Northern Virginia (already home to 13% of global data center capacity) (virginia.gov), Texas, Ohio, Oregon, and increasingly Mississippi, Indiana, and New Mexico. The geographic clustering follows power availability, land costs, and regulatory friendliness.

The job creation story: Amazon's Indiana investment claims 1,100 jobs (amazon.com). Their Mississippi project promises "hundreds" (amazon.com). Texas data centers directly employ around 47,856 workers and indirectly support over 485,000 jobs statewide (businesstexas.com).

The reality: Data center construction creates significant short-term employment. A city can create a lot of construction jobs. But operational jobs are far fewer. A massive $10 billion facility might employ 1,000 people permanently. These tend to be high-paying technical roles (data center technicians, security, facilities management), but they require specific training.

What it means if you live there

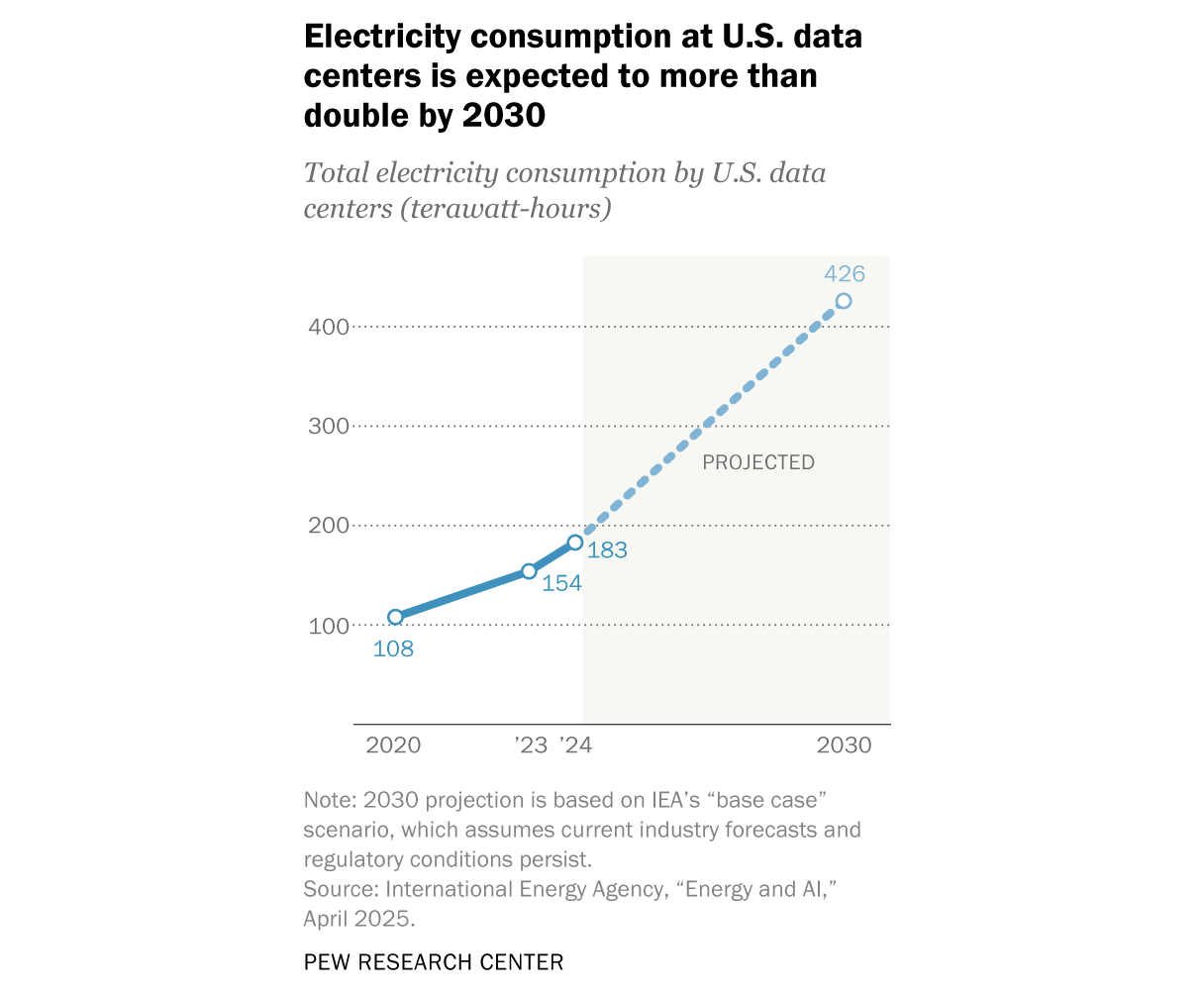

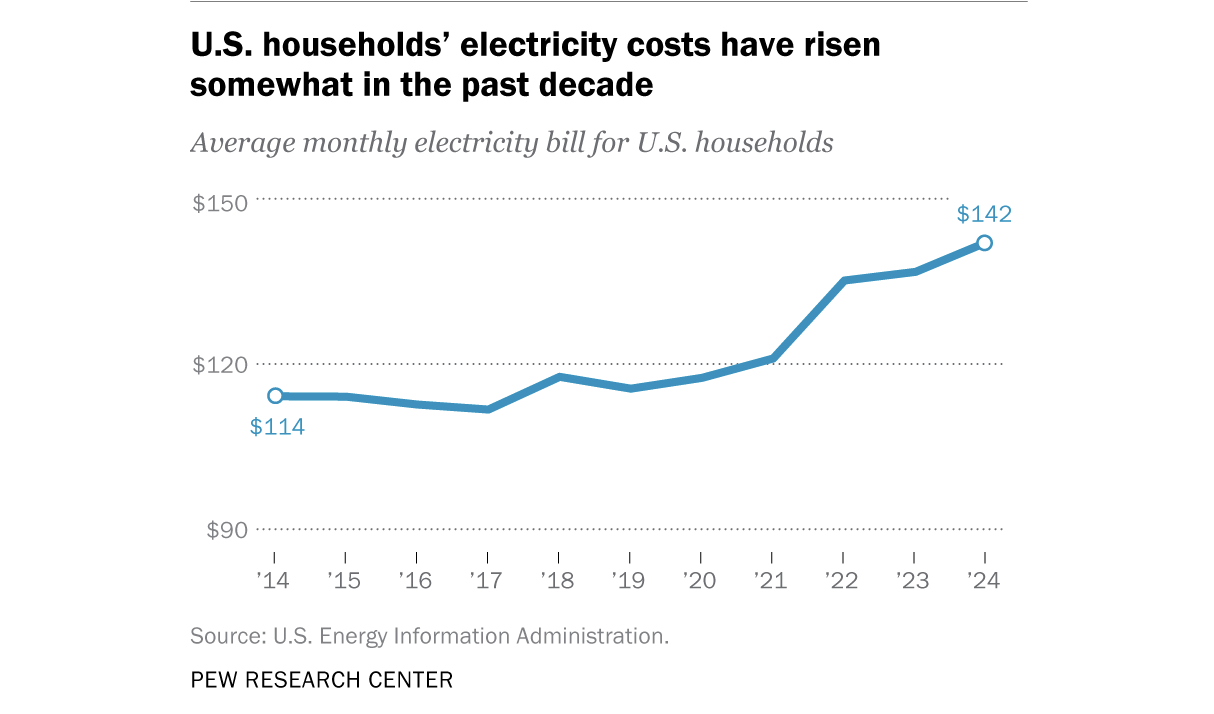

Electricity bills are rising. U.S. data centers consumed 183 terawatt-hours in 2024, over 4% of national consumption (pewresearch.com). By 2030, that's projected to more than double. In Virginia, data centers already consume 26% of total state electricity.

The costs get passed to consumers. A Carnegie Mellon study estimates data centers could lead to an 8% increase in average U.S. electricity bills by 2030, potentially exceeding 25% in Northern Virginia. In western Maryland, residential bills are expected to rise $18/month. In Ohio, $16/month (pewresearch.com). Wholesale electricity prices have risen as much as 267% over five years in areas with significant data center activity (bloomberg.com).

Water consumption is becoming contentious. A mid-sized data center uses about 300,000 gallons daily, which is equivalent to 1,000 homes (npr.org). In Texas, data centers consumed over 50 billion gallons in 2024 while over 70% of the state experienced drought (newsweek.com). Residents face strict water restrictions while data centers operate without similar limits. In Chile, Google paused a $200 million data center after courts ruled it needed to address climate impacts on the region's strained aquifer (reuters.com).

Noise affects quality of life. Data center cooling systems create low-frequency noise that can be felt from a thousand feets away. A Virginia legislative report found about 10% of data centers generate noise that nearby residents regard as problematic (virginia.gov). Residents describe migraines, disrupted sleep, inability to concentrate, sometimes from sound they can't consciously hear but that still affects health.

But there's an upside. In Virginia, AWS paid $542.9 million in property taxes in 2024 (amazon.com). Illinois's data center industry generated $1.85 billion in state and local government support in 2023 (insideclimatenews.org). Companies are funding STEM education, workforce training, and community programs.

However, the real question communities face is: do the taxes and jobs justify the infrastructure strain?

If you're thinking about real estate

Digital infrastructure is becoming real estate infrastructure. A place in the U.S. doesn't just have value based on schools, safety, and square footage, it's also increasingly based on how "future-ready" it is.

AI Cluster Type

| Category | Metro Areas | What defines them |

|---|---|---|

| Superstars | San Francisco, San Jose, Oakland, Sunnyvale, Santa Clara | Highest AI concentration globally. Premium real estate and intense return-to-office pressure. You're paying for proximity to the frontier, and competing with everyone who had the same idea. |

| Star Hubs | New York City, Boston, Seattle, Chicago, Washington DC | Rapid AI growth, relatively more affordable than the Bay Area, and strong infrastructure investment. These metros have density, talent pipelines, and institutional backing to compete. |

| Emerging Centers | Pittsburgh, Madison, Nashville, St. Louis, Detroit | University-anchored with specialized niches. Pittsburgh has CMU computer science & robotics, Madison has UW’s research ecosystem, Nashville is growing as a healthcare-tech hub. Positioned as alternatives to coastal costs. |

| Focused Movers | Portland, Indianapolis, Cleveland | Leaning into signature strengths. Portland has semiconductor ties, Indianapolis has health tech, Cleveland has healthcare and advanced manufacturing. Positioning for specific slices of the AI economy. |

| Nascent Adopters | Smaller metros, rural regions | Limited broadband, talent outmigration, and higher automation vulnerability. Steepest climb, but the most to gain if they can connect. Federal broadband funding (BEAD)* is flowing here. |

*The Broadband Equity Access and Deployment Program (BEAD) Program, funded by the IIJA, is a $42.45 billion federal grant program that aims to connect every American to high-speed internet by funding partnerships to build infrastructure. (broadbandusa.ntia.gov)

Data Center Regions

Northern Virginia (Loudoun, Prince William, Fairfax): 13% of global capacity (npr.org). Electricity costs rising. New zoning requiring setbacks and noise studies. $64 billion in delayed projects (reuters.com). Check proximity to facilities before buying.

Central Ohio (Columbus, New Albany, Plain City): Amazon investing $10+ billion. American Electric Power (AEP) building $2.8 billion in transmission infrastructure (aep.com). Expect rate increases. Workforce programs launching.

Texas (Austin, San Antonio, Dallas-Fort Worth, Abilene): Massive buildout, Stargate's flagship is in Abilene. Over 70% drought in 2024 (newsweek.com). Data centers consumed 50+ billion gallons (lincolninst.edu). Residents face water restrictions; data centers often don't.

Eastern Oregon (Morrow, Umatilla): Amazon invested $39+ billion (oregonlive.com). Remote location means less noise concern. Data centers consume 11% of state electricity. Strong community programs but limited local job market.

Northern Indiana (St. Joseph County): Amazon's $15 billion is the largest private investment in regional history (amazon.com). Less water stress than Texas or Arizona.

Mississippi (Madison, Warren): Largest private investments in state history (amazon.com). Workforce programs launching.

What this reveals

Think about how cities developed around ports, then railroads, then highways. Infrastructure determined which places thrived. The physical UX of a city (its walkability, its transit, its architecture) shapes who lives there and what they can become. Digital infrastructure is no different, the invisible layer of the built environment that increasingly determines economic potential.

The geography of AI is determined by power, fiber connectivity, and skilled talent. Those factors cluster intensely. As Brookings says, "the problem with the narrow geographic scope of data center locations is that it reinforces existing inequities and accelerates the gap between digital 'haves' and 'have-nots.'" (brookings.edu)

If you want to work at the frontier of AI (not just use its outputs, but participate in its development) your options for where to live are seriously constrained. The result: you're increasingly forced to move to specific hotspots. This strains communities, relationships, and affordability.

I live in Pittsburgh because I studied AI at Carnegie Mellon which is one of the best places in the world to learn this field. But most of my classmates left after graduation. They moved to the major tech hubs where the opportunities, funding, meetups, and communities are.

I stayed for another opportunity. And there's a professional loneliness that comes with that. The feeling of being trained at a world-class level but living in a place that isn't fully wired into the ecosystem you studied for. Watching your peers be in networks that simply don't exist where you are. The sense that your work, friendships, opportunities, or even your curiosity, might have grown differently if you were physically closer to the centers of activity.

It taught me something important: location still shapes who gets to build the future. Not only because of skill, but because of proximity.

The pattern underneath all of this: digital infrastructure is becoming as fundamental as roads and water mains. The places investing in it (and managing its downsides) are positioning for the next economy. The places ignoring it are betting the future won't arrive.

And this matters. Because AI will shape everything about how we live, work, and think.

This piece is part of Ode by Muno, where I explore the invisible systems shaping how we sense, think, and create.

The quote at the intro is from the book, Systems Intelligence.

If you found this interesting, you may also enjoy: odebymuno.com/ode/infrastructure-is-invisible-until-it-isnt